Penn Hills Homebuyer Assistance Program

The Penn Hills Homebuyer Assistance Program is designed to provide down payment and closing cost assistance of up to $14,500 in financing in the form of a forgivable second mortgage for the purchase of a home in Penn Hills. This program is designed for homebuyers who meet the following criteria:

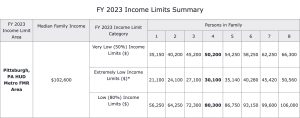

- Homebuyer household income must be equal to or less than the 80% Area Median Income (AMI) limit to qualify for assistance.

- Homebuyer must earn their Homeownership Counseling Certificate from a HUD-approved counseling agency prior to receiving a final financial assistance offer for the housing purchase.

- The home must be the homebuyer’s primary residence.

- The homebuyer must provide a minimum of $500 or three percent (3%) of the total down payment and closing cost expenses, whichever is the lesser of the two, from personal resources.

- Homebuyer must have pre-approval from one of the following first mortgage lenders:

- Dollar Bank

- First Commonwealth Bank

- Huntington Bank

- KeyBank

- Northwest Bank

- PNC Bank

- West Penn Financial

For a property to be eligible it must meet the following conditions:

- It must be located within the corporate limits of the Municipality of Penn Hills.

- It must be in compliance with the minimum property maintenance code for the Municipality of Penn Hills and the Allegheny County HOME Rehab Standards or be capable of being brought up to both jurisdictions’ standards prior to occupancy.

- It must be a vacant single-family attached or single-family detached residence.

- It must not contain evidence of defective paint surfaces (i.e., surfaces upon which paint is cracking, scaling, chipping, peeling or loose) on all intact and non-intact interior and exterior painted surfaces. If the dwelling unit contains defective paint surfaces, the Municipality of Penn Hills reserves the right to deny homebuyer assistance through the HAP for the purchase of the subject property until the conditions are corrected.

- It will be occupied as the primary and principal residence of the homebuyer during the 5-year period of affordability as referenced in Allegheny County’s Recapture Provisions of the HOME Program. Rental properties (whether for primary or secondary uses) are not eligible.

The purchase of the dwelling unit cannot be financed through a lease-purchase agreement, land contract, or seller financing.

If you are interested in participating in this program, please contact us at PennHillsHAP@actionhousing.org or 412-227-5700.